Discovery

User Testing

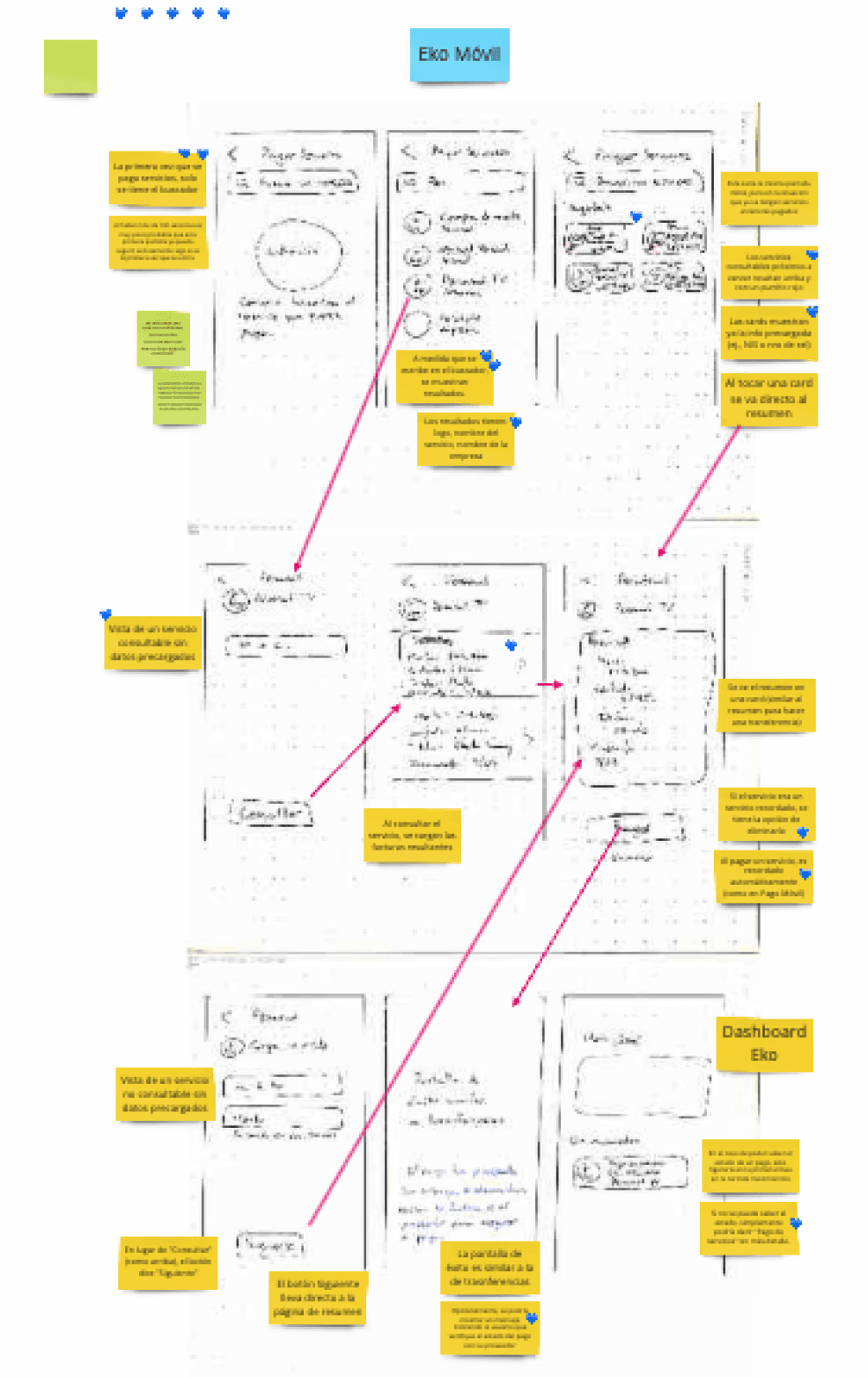

UX/UI Design

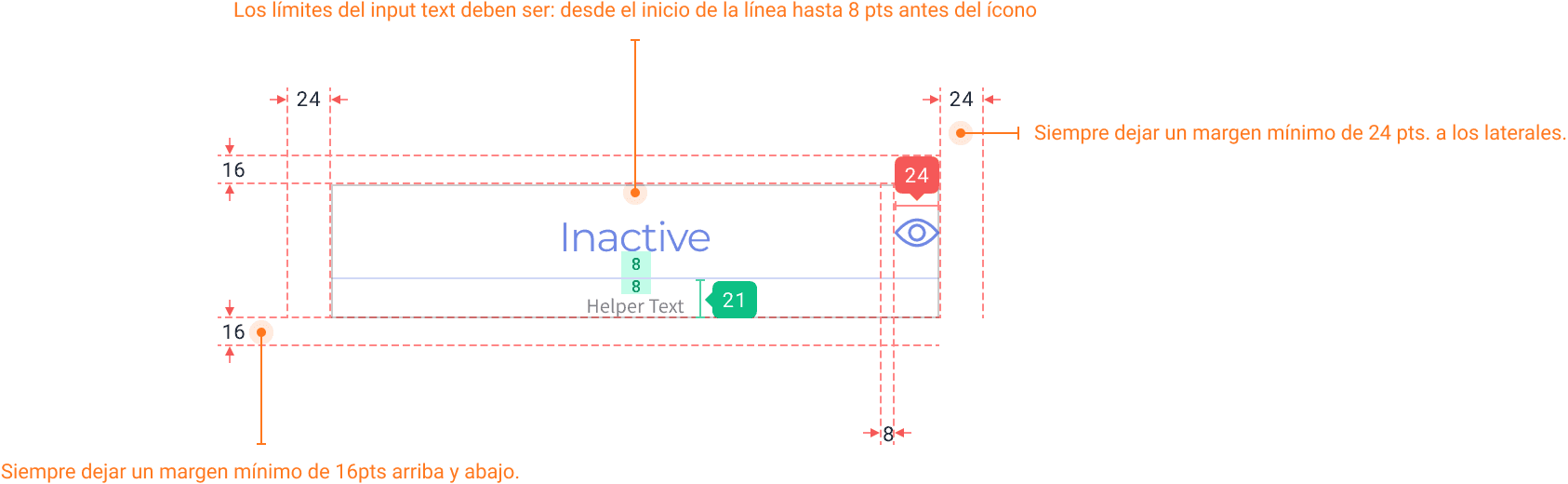

Design System

Client

Eko Digital Bank

Team

1 Design Lead (my role)

2 UX/UI Designers

Tools

Figma, Miro

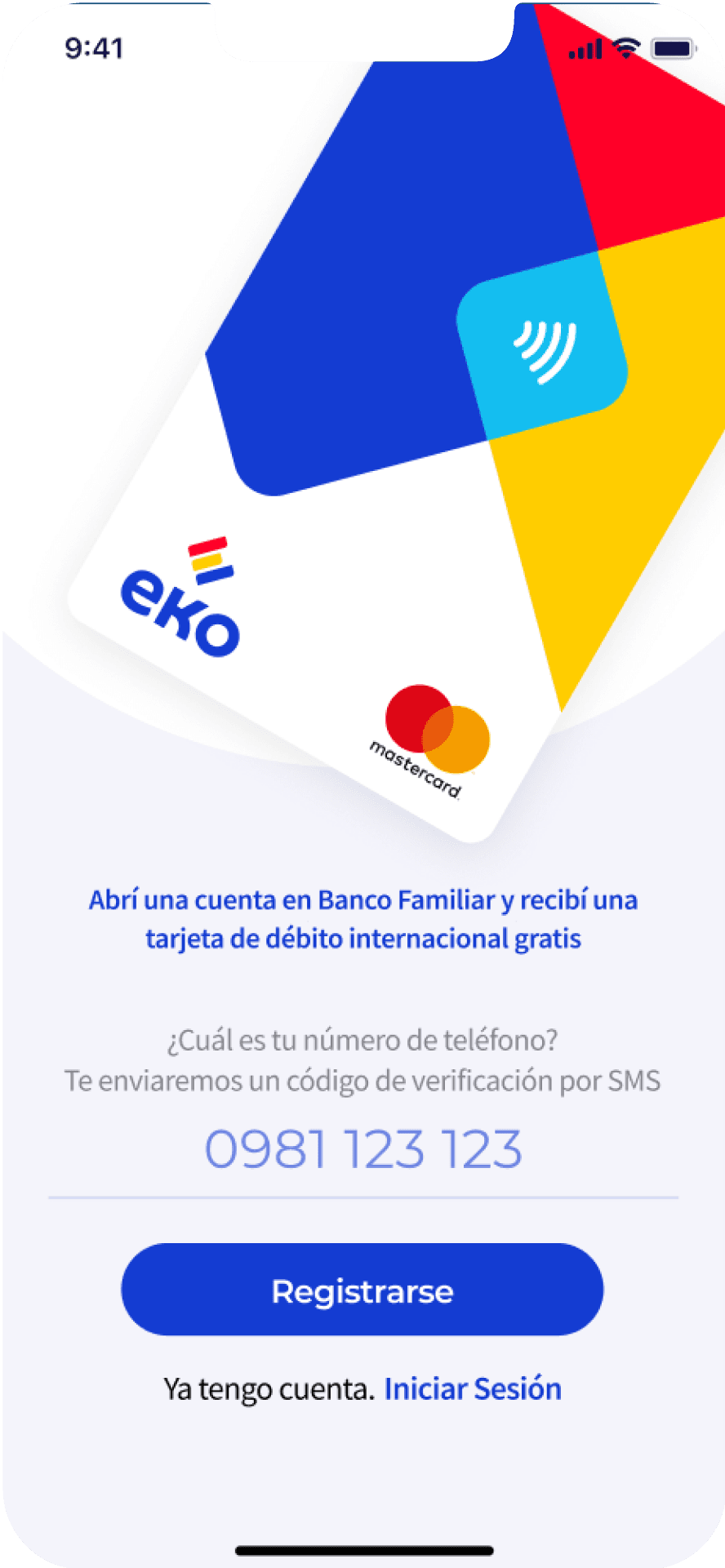

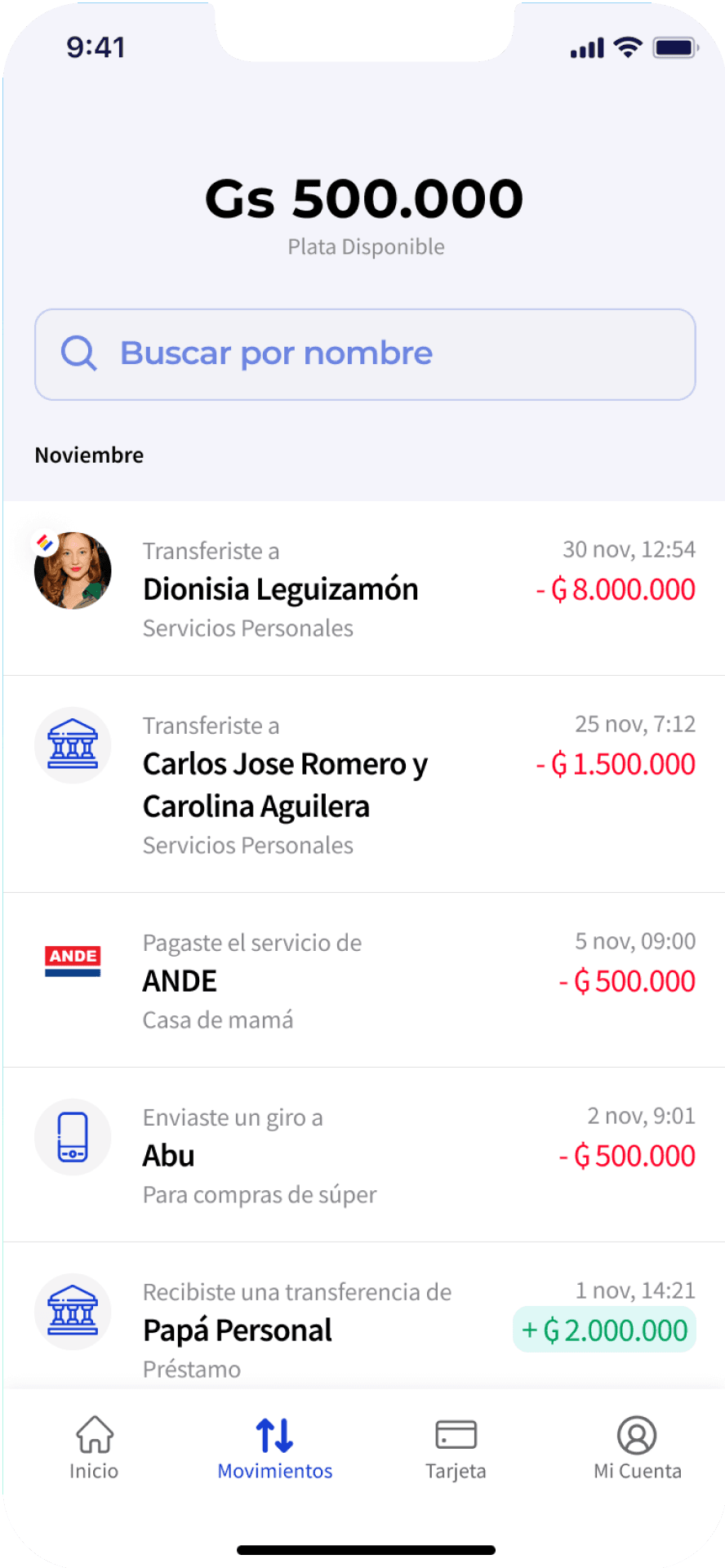

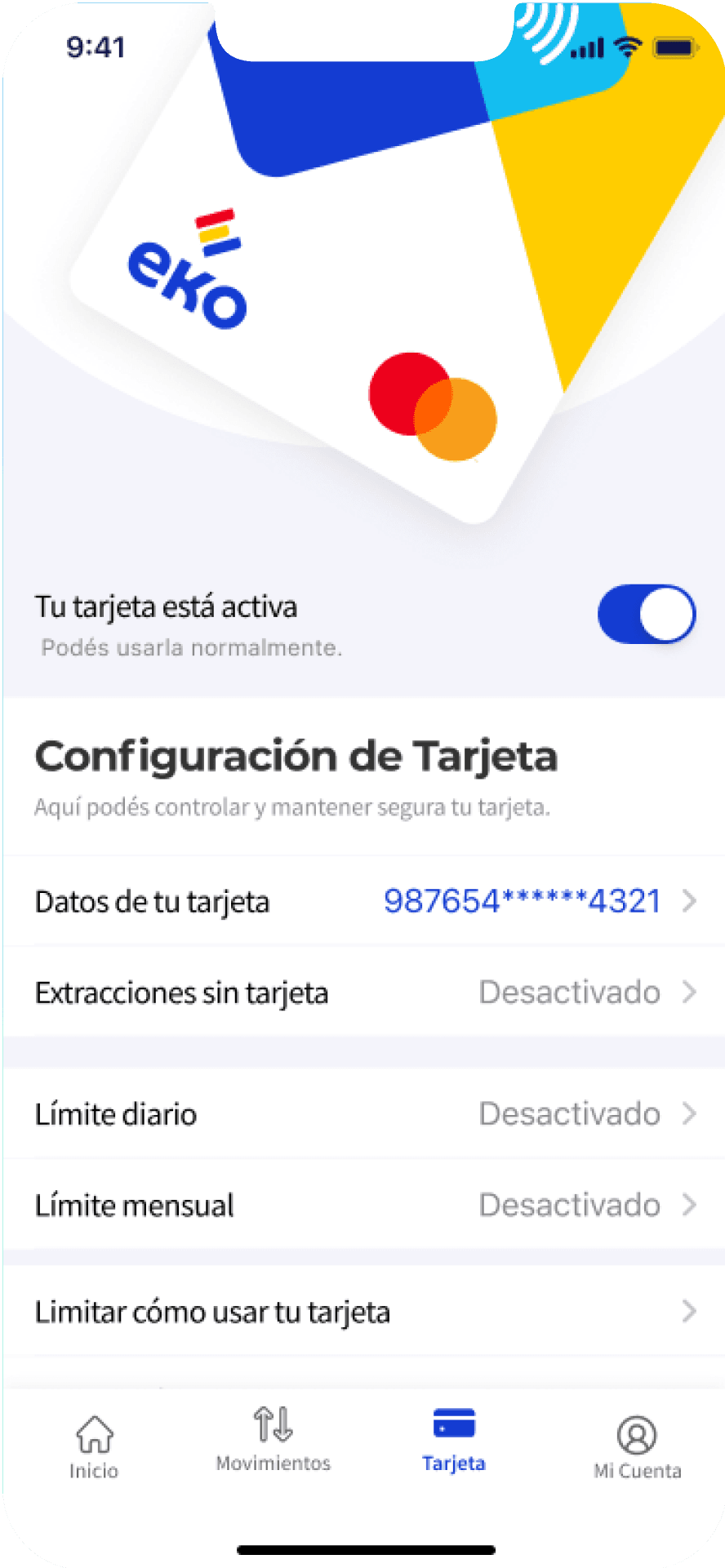

A 100% digital banking experience

Eko is Paraguay’s first fully digital banking platform, designed to provide easy access to financial services for the unbanked population.

Overview

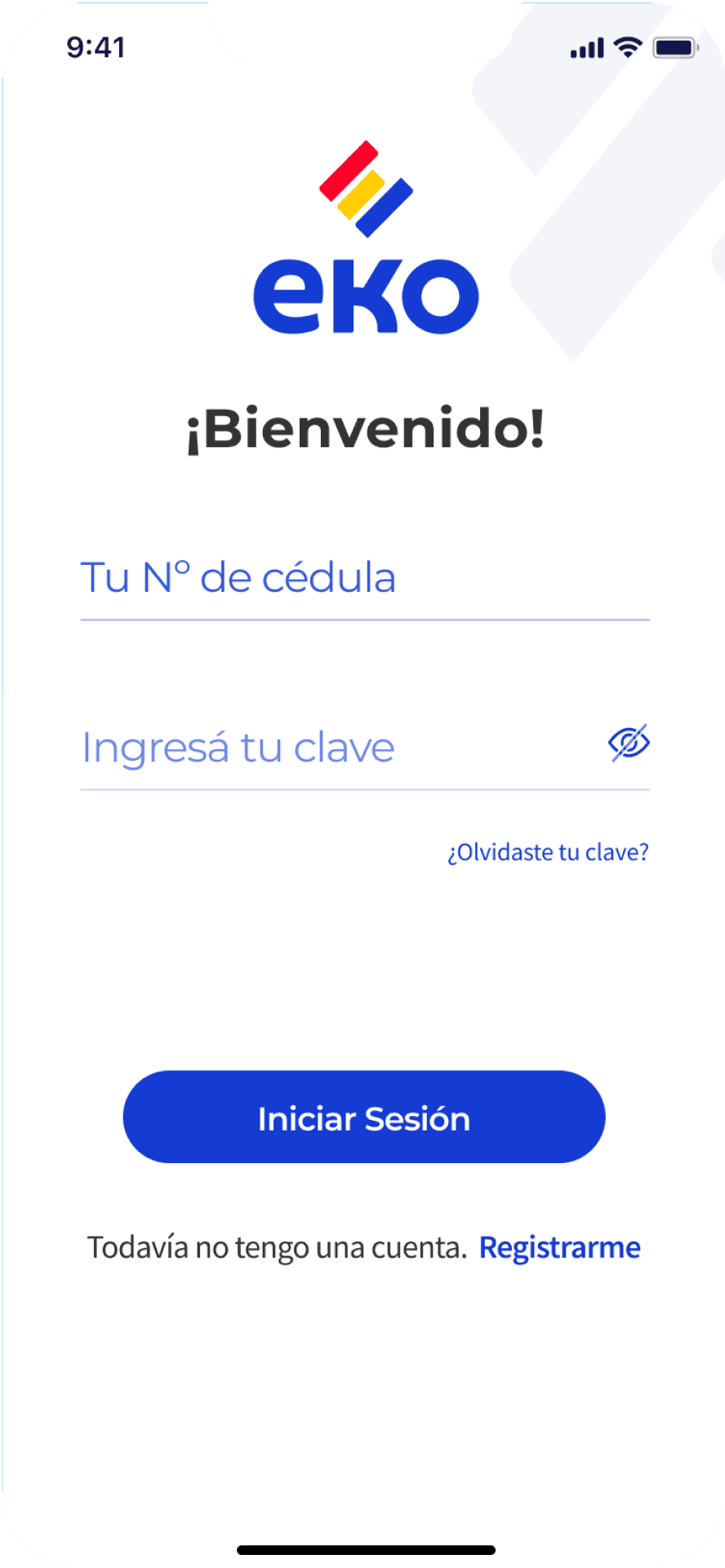

The project’s goal was to create a digital banking platform, enabling users to easily open a bank account and perform transactions via an intuitive interface.

This case study outlines the journey from concept to launch, highlighting the design process for an inclusive and user-friendly app.

Key Results

Over 100,000 accounts created within the first year, representing 2% of Paraguay’s adult population.

Achieved a 25% average monthly growth in 2022, surpassing the growth rate of traditional banks in Paraguay.

The Challenge

How might we facilitate access to financial services in an easy, trustable and 100% digital manner?

With only 30% of the adult population banked, Eko sought to address the barriers to digital banking adoption in Paraguay. Our focus was on overcoming three key issues:

User Trust: Building confidence in banks and digital financial services among a traditionally cash-reliant population.

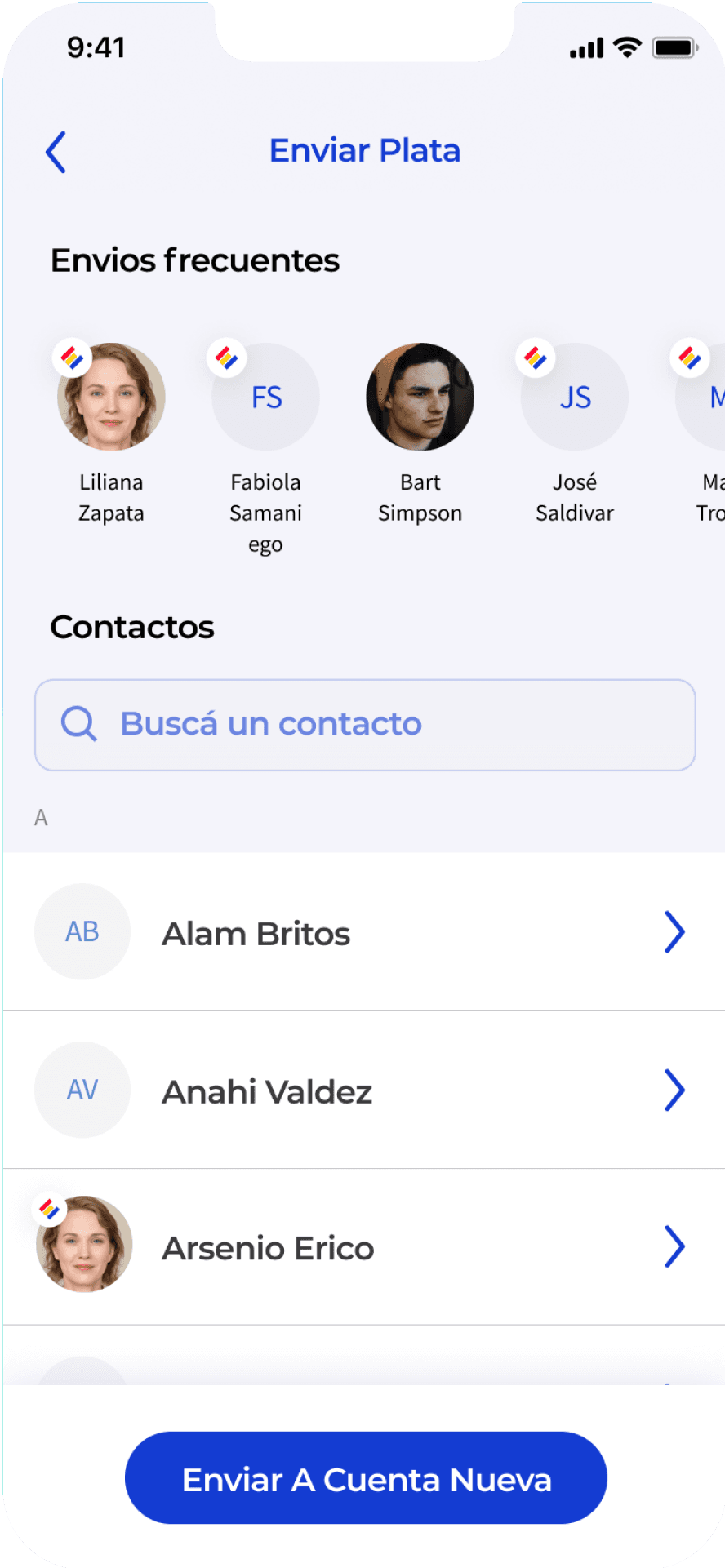

Behavioral Shift: Encouraging users to transition from cash-based transactions to digital payments.

Inclusion: Designing for users with varying levels of digital literacy, using smartphones with limited capabilities.

Process

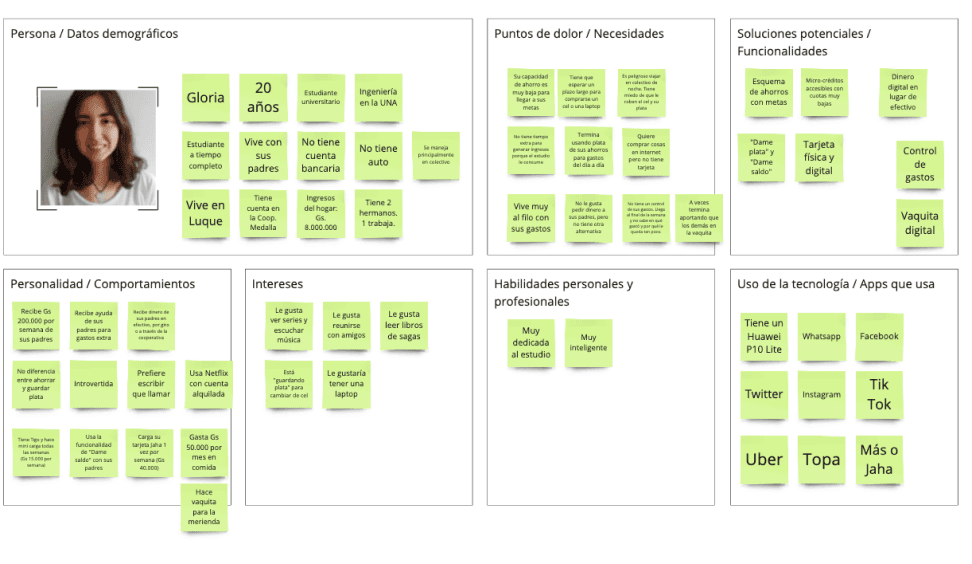

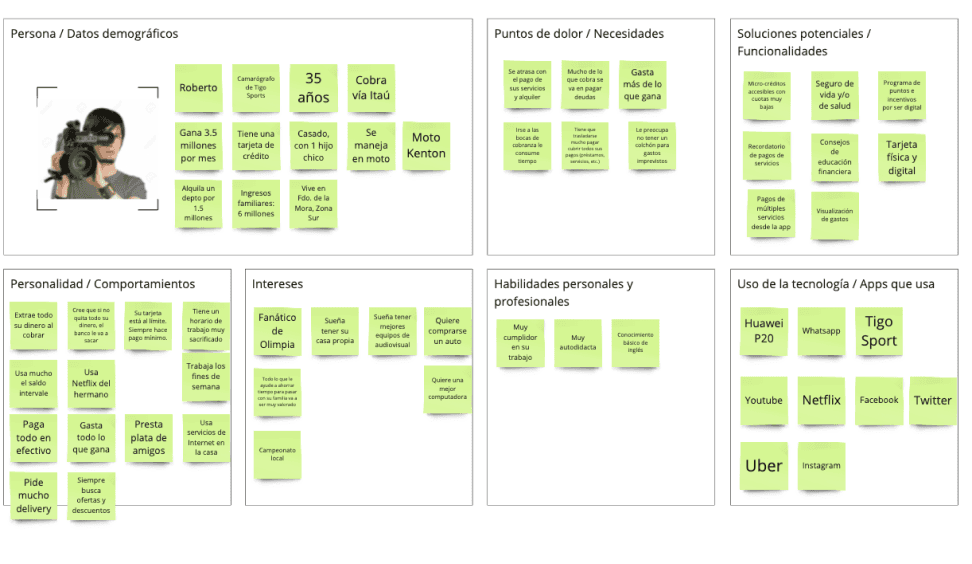

Research and Discovery: Gathered initial insights from an outsourced firm’s research, identifying key user pain points and mistrust in traditional banking.

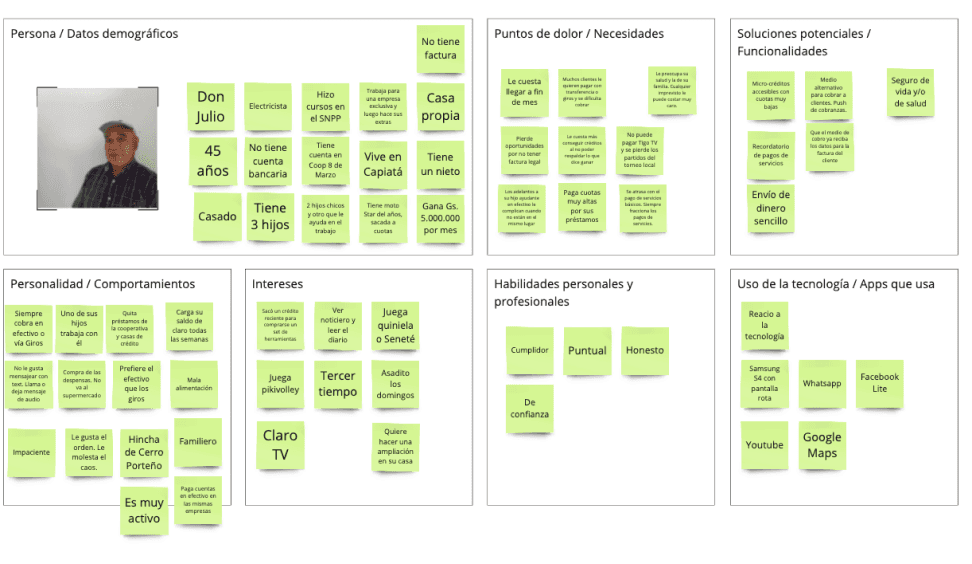

Team Alignment: Facilitated workshops to align the team on the vision and goals, creating proto-personas and refining the problem statement.

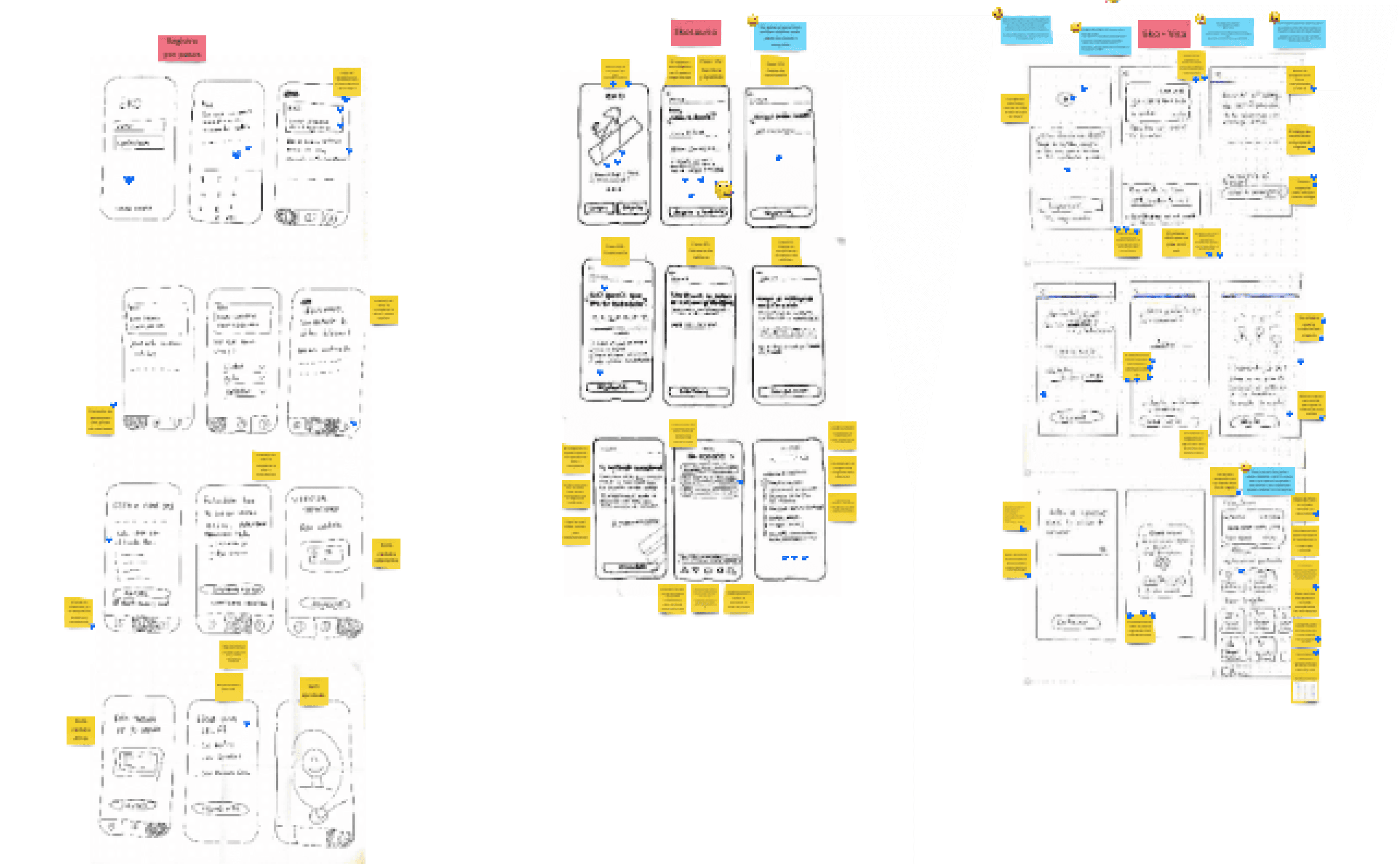

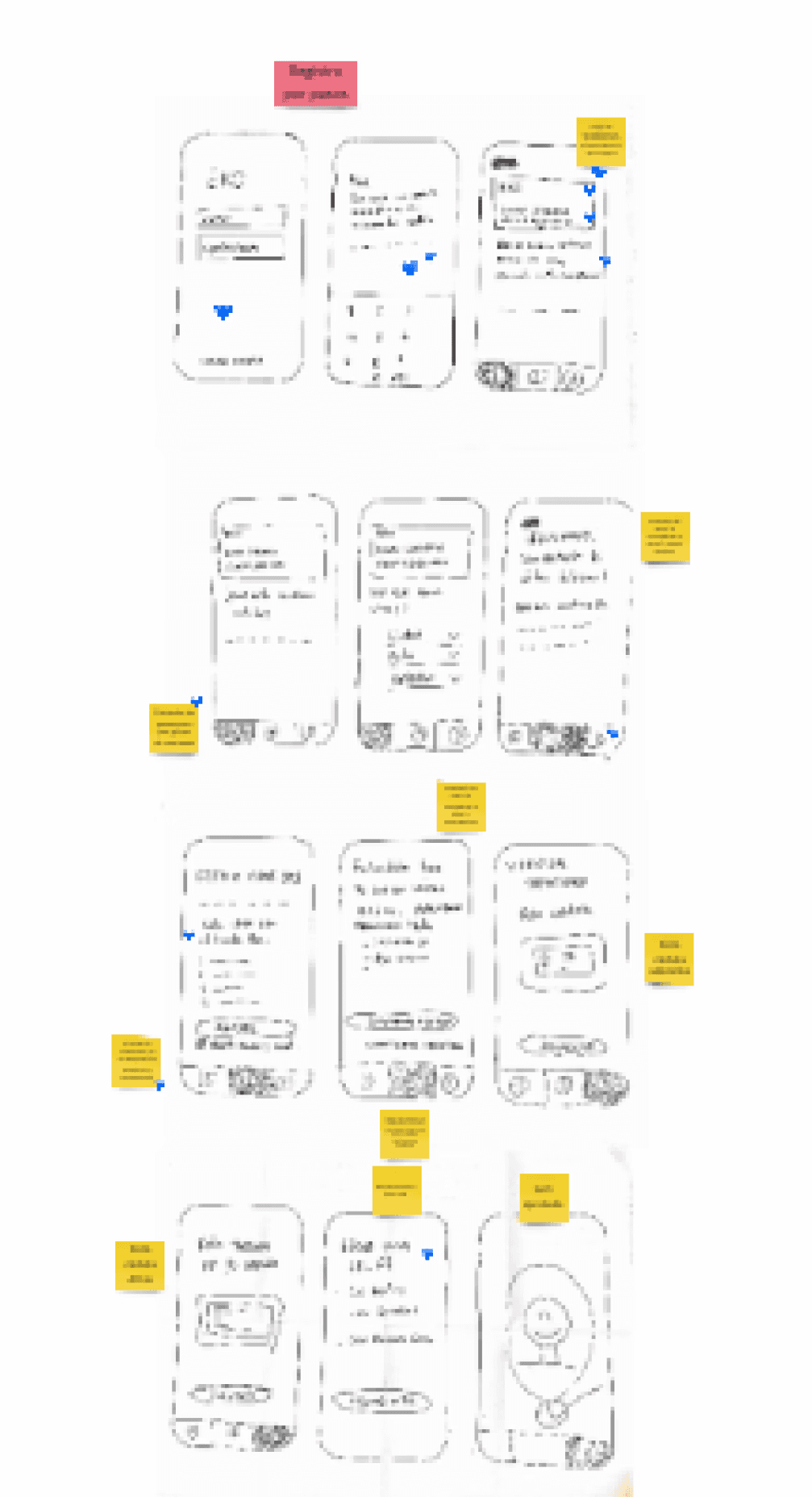

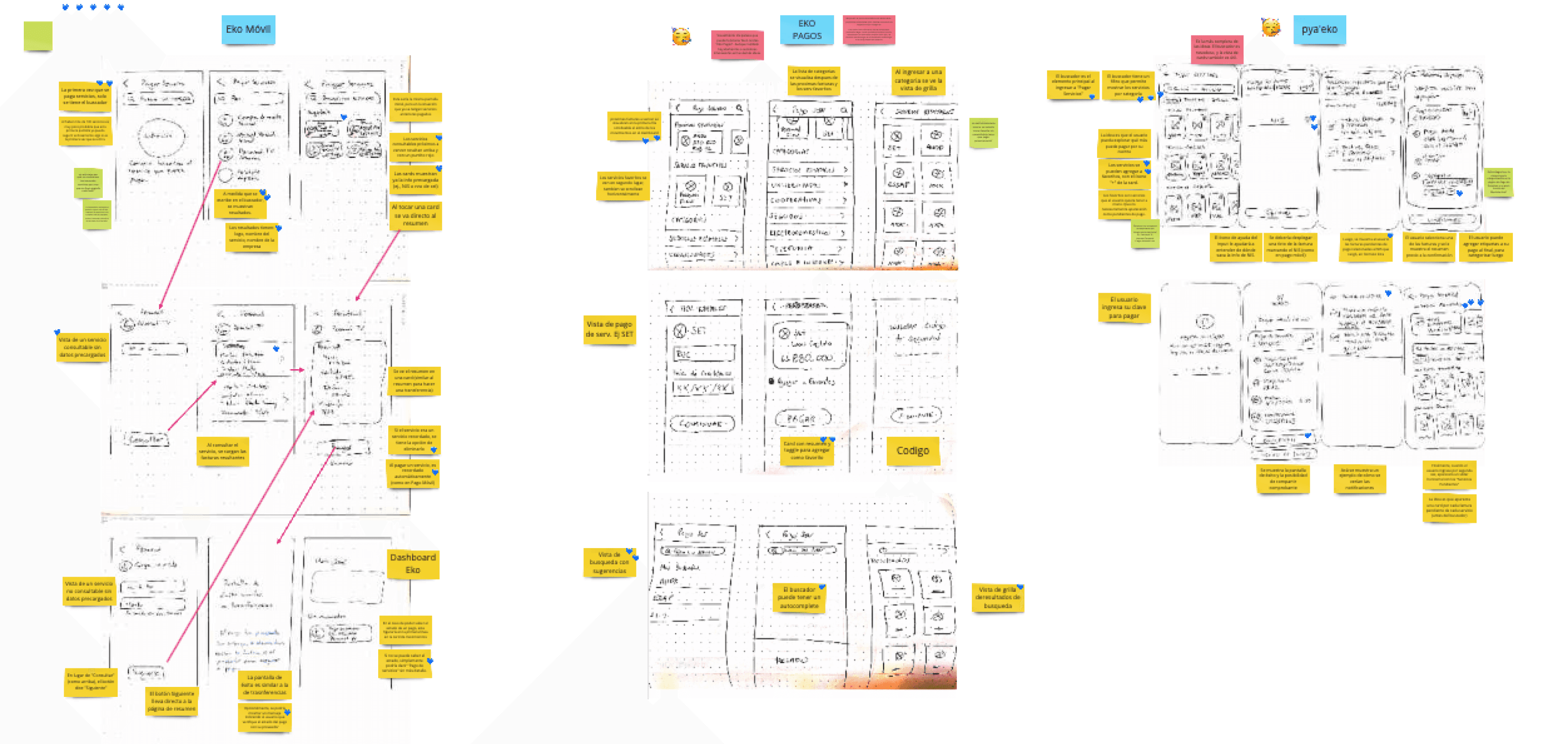

Design Sprints: Conducted iterative design sprints to prototype and test features, ensuring alignment with user needs and business objectives.

Feature Prioritization: Prioritized key features for the MVP using a risk/impact matrix, linking user needs, business goals, and metrics.

Prototyping and User Testing: Developed and tested high-fidelity prototypes with users to gather feedback and refine designs.

Team alignment

Hypotheses definition

Feature prioritization using an effort/impact scale

Proto-persona definitions

Mapping the user experience

Low-fidelity concepts

Thoroughly documented Design System

Outcome

Our work with Eko resulted in a novel digital banking platform that significantly impacted financial inclusion in Paraguay with over 100,000 new bank accounts created.

The user-friendly and modern UI set Eko apart from traditional banks, conveying friendliness and trust while ensuring a secure experience.

A streamlined, guided onboarding process, combined with intuitive user flows for essential actions like sending money and making payments, turned users into enthusiastic supporters.

© 2024 Alberto Samaniego